Tilted Scales: How Government Policies Favor the Wealthy and Elderly

Exploring the Impact of Economic Inequities and Seeking Paths to a Fairer Future

Introduction: Confronting Hard Truths in Economic Equity

Writing this article has been a challenging endeavor. As someone who values classical liberalism, I find myself grappling with principles that often seem in conflict with the harsh realities faced by younger generations today. This piece is an exploration into a troubling economic landscape, one that increasingly appears to disadvantage the youth.

In delving into the economic disparities that characterize modern America, I've had to confront uncomfortable truths about the systems and policies that I once believed in more staunchly. The evidence is compelling—statistical data, personal narratives, and policy analyses collectively paint a picture of a system skewed in favor of the older and wealthier, often at the expense of younger individuals who are just starting out.

This article is my attempt to untangle these complexities and shed light on the significant economic challenges confronting young people today. From laws that disproportionately benefit the wealthy to social structures that stymie the financial independence of new generations, it's clear that the scales are not balanced. Join me as we explore these issues, not just to understand them better, but to consider what actions can be taken to forge a fairer future.

Statistics: Painting a Stark Picture

The financial challenges faced by younger generations today aren't just anecdotal; they are starkly illustrated by hard statistics that reveal a widening gap between the opportunities available to today's youth compared to those their parents enjoyed. This section will delve into the economic realities that underscore the concept of generational theft, highlighting how systemic shifts in economics have disproportionately disadvantaged Gen Z and millennials.

The Rising Costs of Housing

Housing prices have experienced a dramatic rise over the past few decades, significantly outpacing the growth in median wages. An upcoming graph will detail this trend since June 2001, clearly demonstrating how salaries have not kept pace with the escalating cost of purchasing a home. This disparity has made homeownership increasingly out of reach for many younger, first-time home buyers.

Additionally, the graph illustrates the significant increase in interest rates from the onset of COVID-19 to the present. This rise in rates further complicates the ability of young people to enter the housing market, as higher interest rates translate to higher monthly mortgage payments, making it even more challenging for this demographic to afford a home.

Education Costs vs. Salaries for the College Educated

Since 2001, the financial return on investing in a college education has dramatically shifted. Indexed to 2001, the cost of college tuition has surged by approximately 150%, while the nominal weekly earnings for those with a college degree have only increased by about 80%.

This disparity highlights a shrinking return on investment for higher education, which is further exacerbated by the growing burden of student loan debt. Many graduates now face bloated student loan balances, adding financial stress and diminishing the economic value of their degrees.

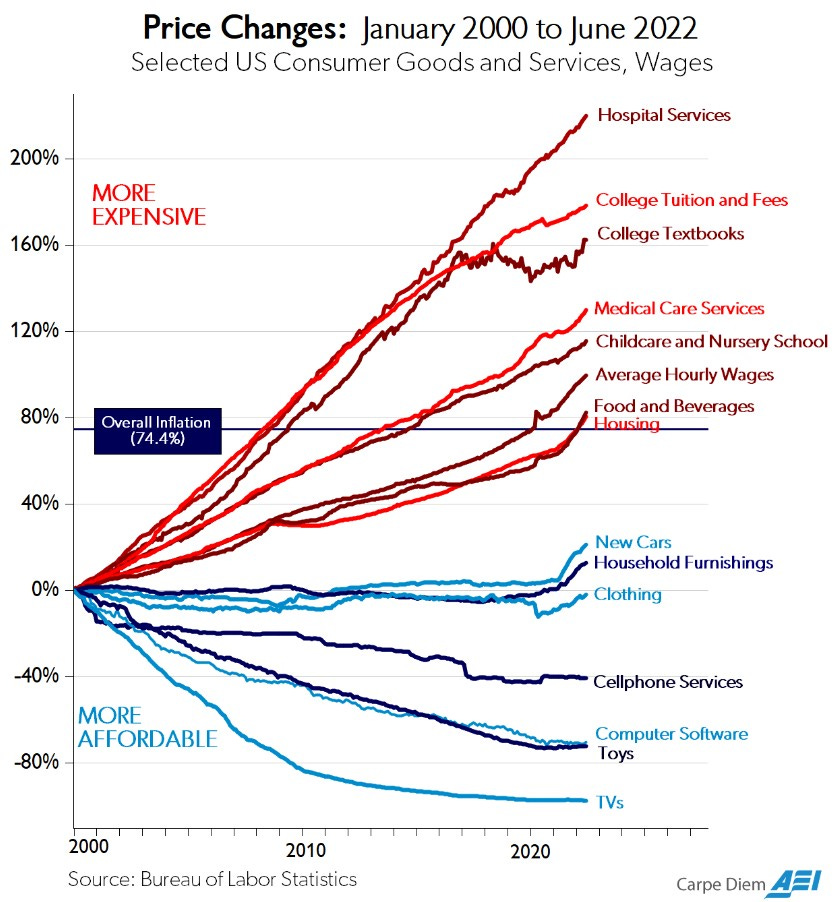

Inflation Across Different Sectors

An image from the American Enterprise Institute visualizes inflation over time across various sectors, emphasizing areas critical to younger demographics. Notably, sectors such as healthcare, college education, and childcare top the list, all increasing much higher than the general inflation rate.

These sectors are not only significant expenses but are also highly regulated, which may contribute to their disproportionate cost increases. Younger people, who are typically more involved in higher education and childcare due to their life stages, feel these impacts more acutely.

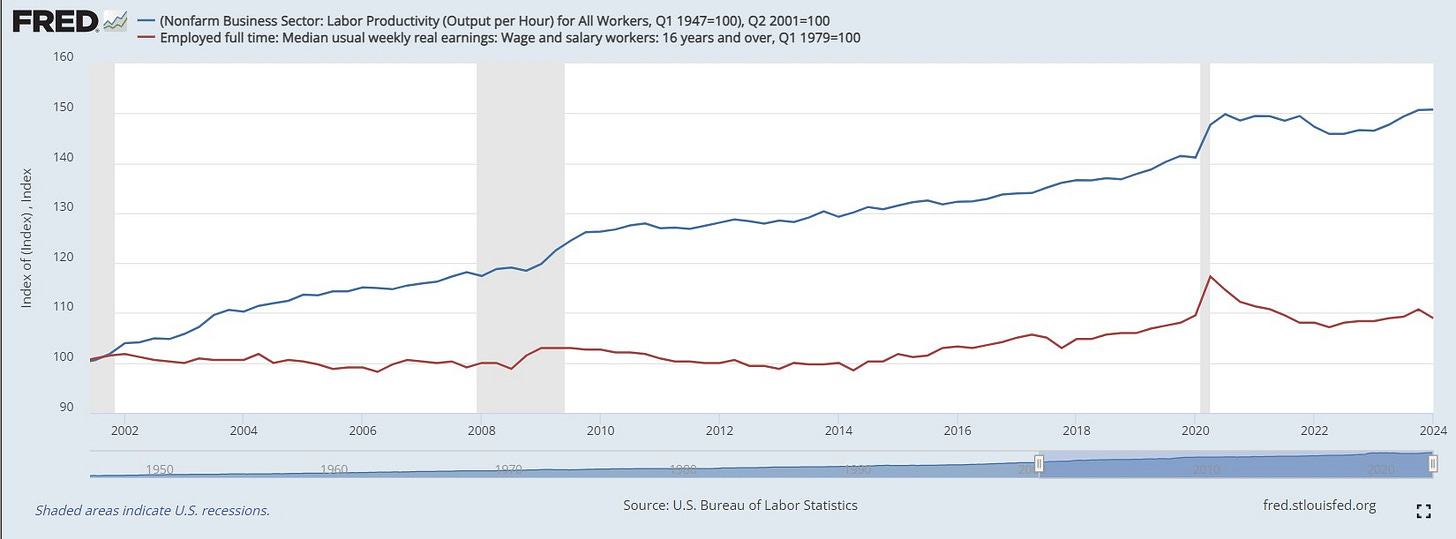

Stagnant Wages vs. Increased Productivity

In the last 23 years, there has been a significant disconnection between worker productivity and wages. Despite advances in technology and connectivity that have greatly enhanced worker productivity, wages have not kept pace with these productivity gains. Note there has been little gain in productivity since COVID, likely due to capital misallocations due to ZIRP.

This divergence indicates that the economic benefits derived from increased productivity have predominantly gone to capital holders, who are more likely to be older and wealthier, rather than to wage earners, who are often younger and poorer. This imbalance highlights a fundamental shift in how economic gains are distributed, favoring capital over labor and exacerbating generational wealth gaps.

Wealth Distribution Trends

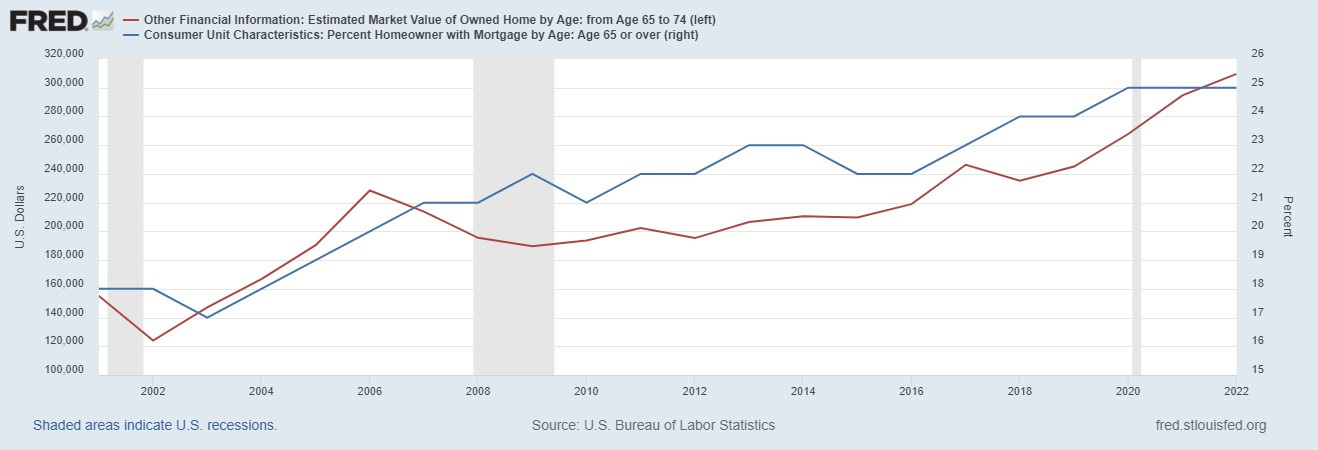

The disparity becomes even more evident when examining wealth distribution. According to data from the Federal Reserve, as of June 2001, people aged 55 and older owned 55.6% of the nation's wealth. By December 2023, this share had increased dramatically to 73.2% of the total wealth.

This shift is likely influenced by significant increases in home values for individuals over 65, which have doubled from approximately $155,000 to $310,000 in this time period. Additionally, the percentage of seniors with mortgages has increased slightly during this period, suggesting that many are tapping into their home equity and not leaving their wealth to future generations.

Declining Homeownership Rates and the Real Estate Boom

Homeownership rates among younger Americans have also declined, despite housing units keeping pace with population growth.

Upcoming visualizations from the Federal Reserve will show how real estate has surged as a significant contributor to household wealth in the U.S. since the pandemic began.

This increase in real estate value has disproportionately benefited those already holding property, thereby contributing to wealth accumulation largely for older generations and leaving younger individuals struggling to enter the market.

These statistics collectively illustrate a troubling economic landscape for younger generations—a landscape shaped by higher costs, stagnant wages, and diminishing wealth accumulation opportunities. This reality supports the argument that today's youth are not just facing personal financial mismanagement issues but are up against systemic barriers that were less pronounced for previous generations.

Laws and Policies Facilitating Wealth Transfer

In the American economic landscape, a number of laws and policies systematically facilitate the transfer of wealth across different demographic groups. These transfers often occur from the less economically advantaged or younger generations to more affluent or older demographics. This section will explore several key areas where such wealth transfers are most evident, including housing policies that favor homeowners over renters, social insurance programs funded predominantly by the younger workforce, and tax policies that disproportionately benefit the wealthy.

Housing Policies: From Renters to Homeowners

Homeownership in the United States is heavily incentivized through tax deductions that disproportionately benefit homeowners at the expense of renters, who are often younger and less affluent. Two significant examples of this are the mortgage interest deduction and the state and local tax (SALT) deduction.

Mortgage Interest Deduction: This policy allows homeowners to deduct interest paid on up to $750,000 of mortgage debt from their taxable income. While this deduction is defended as a means to encourage homeownership, it primarily benefits homeowners in higher tax brackets with more expensive homes, effectively subsidizing wealthier individuals and exacerbating the wealth gap between homeowners and renters.

State and Local Tax (SALT) Deduction: The SALT deduction allows taxpayers to deduct local property taxes and either state income or sales taxes from their federal taxable income. This deduction tends to favor wealthier individuals in high-tax states, who are more likely to own homes and pay higher property taxes, thus receiving greater tax relief compared to renters and individuals in lower tax brackets.

Social Insurance Programs: From Young to Old

Social Security and Medicare are cornerstone social insurance programs in the United States, designed to provide security and healthcare to the elderly. However, the funding mechanism for these programs creates a wealth transfer from the younger working population to older retirees.

Social Security: Funded through a payroll tax on current workers, Social Security is a direct transfer of money from younger employees to older, retired beneficiaries. As the population ages and the ratio of workers to retirees decreases, the burden on younger workers increases, exacerbating intergenerational inequity.

Medicare: Similarly, Medicare is primarily funded through payroll taxes and premiums paid by current workers. As healthcare costs continue to rise and the elderly population grows, the financial strain on younger generations intensifies, representing another form of wealth transfer from the young to the old.

The notable increase in wealth among the senior population raises critical questions about the current structure of social security and Medicare. Should these programs be means-tested? Do all seniors need this level of support, or are we seeing younger, poorer workers subsidizing the lifestyles of affluent seniors? While it's clear that some seniors rely heavily on these benefits, a significant portion of this demographic does not, prompting a reevaluation of how these benefits are distributed.

Tax Policies: From Middle-Class to Wealthy

Several tax policies disproportionately benefit the wealthy, often at the expense of the middle class and economically less advantaged groups. These include favorable rates on capital gains and incentives such as electric vehicle (EV) credits.

Capital Gains Tax Rates: Long-term capital gains, or profits from the sale of assets held for more than a year, are taxed at lower rates than ordinary income. This significantly benefits wealthy individuals, who are more likely to own substantial investments and assets, allowing them to accumulate wealth at a faster rate than those who earn primarily through wages.

Electric Vehicle (EV) Credits: While designed to encourage the adoption of environmentally friendly technology, EV credits often end up subsidizing wealthier individuals who can afford new, expensive electric cars. These credits are less accessible to lower-income individuals, who may not have the financial means to purchase new vehicles without significant incentives.

In the discussion on tax policies that favor the wealthy, it is important to acknowledge the conservative perspective that historically, the U.S. has preferred lower capital gains tax rates for several economic reasons. Proponents argue that lower taxes on capital gains encourage investment in businesses and innovation, stimulate economic growth, and promote job creation by providing investors with more capital to deploy. This preferential treatment is seen as a way to leverage private investment to drive broader economic benefits.

Additional Wealth-Transferring Mechanisms

Other policies also contribute to wealth transfer from the broader, often younger population to more affluent, older individuals:

Retirement Savings Tax Incentives: Tax-advantaged retirement accounts like 401(k)s and IRAs benefit those with higher incomes more, as they are more likely to have the extra funds to contribute and thus gain more from tax deductions or deferrals.

Real Estate Investment Trusts (REITs): REITs offer tax advantages that disproportionately benefit wealthy investors who can invest large sums in real estate portfolios, often generating significant returns shielded from usual corporate income taxes.

Non-Profits and Charitable Deductions: Charitable deductions offer another avenue for wealth transfer, where the wealthy can significantly reduce their tax liabilities. By donating appreciated assets to non-profits, wealthy individuals can avoid paying capital gains tax on those assets, while also receiving a tax deduction for the full market value. This mechanism not only allows for substantial tax savings but also enables the affluent to exert influence over social and cultural domains through philanthropy, effectively bypassing taxes that could otherwise contribute to public coffers.

These examples illustrate a broader trend where certain laws and policies not only perpetuate but exacerbate existing wealth disparities. By understanding these mechanisms, we can better discuss and debate potential reforms aimed at creating a more equitable economic system.

Why Is This Happening?

The structural imbalances in wealth distribution, and the policies that exacerbate them, are not arbitrary but the result of deep-rooted systemic factors and deliberate legislative choices. Understanding why these policies exist and how they are maintained requires examining a combination of economic, political, and cultural factors that influence American society.

Economic Factors: The Shift to a Service-Based Economy

The transformation of the American economy from manufacturing to services has had profound effects on wealth distribution. This shift has led to a polarization of job opportunities with high-skill, high-wage jobs on one end and low-skill, low-wage jobs on the other. Middle-class jobs that once offered a stable income and benefits without requiring a college degree are now less common, which has widened the economic gap between different societal segments.

Productivity vs. Wages Discrepancy: As discussed in previous sections, despite increases in worker productivity—largely due to technological advancements—wages have remained stagnant for the majority of workers. The benefits of increased productivity have flowed upwards to executives and shareholders rather than being shared across the workforce. This trend reflects broader economic policies that favor capital over labor, emphasizing investment returns over wage growth.

Political Factors: Lobbying and Policy-Making

The influence of wealthy individuals and corporate lobbyists in politics cannot be overstated. These entities often have the resources to sway legislative and regulatory frameworks in their favor, perpetuating systems that privilege the already wealthy at the expense of others.

Legislation Favoring the Wealthy: Many of the laws that facilitate wealth transfer, such as favorable capital gains tax rates and specific tax deductions for homeowners and investors, have been strongly supported by lobbying groups representing affluent interests. These groups ensure that policy proposals favorable to them are pushed forward, while those that could disrupt their economic advantages are stalled or diluted.

Voting Patterns and Contributions

It's crucial to consider the political dynamics at play. Seniors typically vote at higher rates than younger people and possess more disposable income, which they can use to contribute to political causes. This demographic's active participation in elections and their financial contributions to political campaigns give them substantial influence over public policy.

Voting and Contributions by Seniors: The higher voting rates and financial contributions of seniors allow them to exert significant influence on politics. Consequently, policies often reflect the priorities and interests of older voters, reinforcing economic structures that may disadvantage younger generations.

Cultural Factors: American Dream and Homeownership

The cultural ethos of the United States places significant emphasis on individualism and the "American Dream," which traditionally includes homeownership as a key component. This cultural narrative supports policies that disproportionately benefit homeowners, such as mortgage interest deductions and property tax breaks, under the guise of promoting independence and self-sufficiency.

Generational Expectations: Older generations who benefited from these policies tend to view them as essential and justified, often overlooking how these benefits have been accrued on the backs of younger, less economically secure populations. This generational divide is also reflected in voting patterns, with older adults more likely to vote and, thus, more likely to influence policies in their favor.

The Role of Financial Institutions

Financial institutions play a significant role in shaping economic policy and the distribution of wealth. They are instrumental in determining who gets access to capital and under what terms. The consolidation of wealth within these institutions, particularly in the aftermath of the Great Recession, has enabled them to exert considerable influence over economic policies.

Credit Availability and Debt: The expansion of credit and the encouragement of debt as a means for economic growth have disproportionately affected younger people, who now enter adulthood with substantial student loan debt, making it harder for them to accumulate wealth early in life.

Systemic Resistance to Change

Lastly, there is a systemic resistance to change within political and economic systems. Reforms that could potentially redistribute wealth or create more equitable economic conditions are often met with strong resistance from those who would lose out. This resistance is not just political but also economic, as markets react to and often resist regulatory changes that threaten established profit models.

Entrenched Interests: The entrenched interests of those in power—whether through wealth, position, or age—make significant reforms challenging. These interests often control or influence media narratives, educational content, and public discourse, shaping a societal understanding that supports the status quo.

Understanding why these wealth disparities and transfers occur provides a clearer picture of the systemic changes needed. It highlights the need for comprehensive policy reforms that address not only the symptoms of economic inequality but also its root causes, involving a restructuring of both market practices and policy frameworks to foster a more equitable distribution of resources.

Scott Galloway's Solutions: Idealism vs. Pragmatism

Scott Galloway, a professor of marketing and a well-regarded public intellectual, offers a series of solutions to the problems of economic inequality and generational theft that have stirred significant debate. His proposals often involve a robust use of government intervention to redistribute wealth and address systemic inequities. In this section, we will explore Galloway's solutions, the philosophical debates they spark, and the pragmatic considerations that might make them appealing despite ideological reservations.

Galloway's Proposed Solutions

Scott Galloway advocates for several policies aimed at correcting what he sees as failures in the market system to provide fair opportunities for all citizens. His suggestions include:

Enhanced Taxation of the Wealthy: Galloway proposes higher tax rates on the wealthy and the implementation of wealth taxes to reduce inequality and fund public services.

Regulation of Tech Giants: He argues for stricter regulations on major tech companies to prevent monopolistic behaviors and ensure a more level playing field for new entrants.

Universal Basic Income (UBI): Galloway supports the idea of a UBI to provide a safety net for all citizens, reducing poverty and giving people more freedom to pursue education and entrepreneurship without the immediate pressure of economic survival.

Increased Investment in Education: He advocates for more significant government investment in education, particularly in technology and vocational training, to better prepare young people for the demands of a rapidly changing economy.

Philosophical Debates: Libertarianism vs. Liberal Interventionism

Galloway's solutions naturally spark a philosophical debate between those who favor minimal government intervention, such as libertarians, and those who believe in more active government roles in correcting market failures, often found among liberals.

Libertarian Critiques: From a libertarian viewpoint, Galloway's proposals may seem antithetical to economic freedom. Libertarians typically argue that government interventions distort the market, inhibit personal responsibility, and ultimately lead to less economic efficiency and freedom. They might contend that Galloway's approach would increase government dependency and stifle individual initiative and innovation.

Liberal Defense: On the other side, liberals might defend Galloway’s approach by emphasizing the role of government in providing a level playing field and correcting injustices inherent in unchecked capitalism. They argue that without such interventions, inequality becomes entrenched, and the wealthy can disproportionately influence the political and economic systems to perpetuate their advantages.

Pragmatic Considerations

Despite philosophical reservations, there are several pragmatic reasons to consider Galloway's solutions, especially in the context of the seemingly intractable problems of today's economic landscape.

Systemic Failures: The current economic system has demonstrably failed to distribute the benefits of growth equitably, as evidenced by the widening wealth gap and reduced social mobility. Galloway’s solutions aim to address these systemic failures by reallocating resources more fairly.

Political Feasibility: Some of Galloway’s proposals, such as enhanced regulation of tech giants, have bipartisan support and could be seen as politically feasible steps toward larger reforms.

Preventing Extremes of Disparity: The extreme economic disparities seen today can lead to social unrest and political instability. Policies that mitigate these disparities, even if imperfect, can contribute to social cohesion and stability.

Navigating Between Idealism and Pragmatism

While Galloway's solutions may not sit comfortably with those who hold a libertarian view, the pragmatic aspect of his proposals cannot be entirely dismissed. The challenge for many, then, is to navigate between idealism and pragmatism — acknowledging that while the solutions may not be perfect or entirely aligned with libertarian ideals, they might represent the best available options for making tangible improvements in people's lives within the current system.

Balancing Act: It involves weighing the potential benefits of these policies against the philosophical costs of increased government intervention.

Long-Term Vision: Supporters of Galloway's ideas might argue that the ultimate goal is to create a more robust, fair, and stable society that could eventually reduce the need for such interventions as the market becomes more genuinely competitive and equitable.

In conclusion, while Scott Galloway’s solutions might challenge libertarian principles, they bring to the table a set of pragmatic responses to urgent socio-economic issues. The discussion between idealism and pragmatism is not just an academic exercise but a necessary deliberation in crafting policies that aspire to both fairness and efficiency in a rapidly evolving world.

Reflecting on Wealth Accumulation and Generational Frustration

As we delve deeper into the nuances of economic disparity, it's crucial to consider the emotional and philosophical dimensions of wealth accumulation in today's society. High-profile figures like Warren Buffett and Elon Musk symbolize the pinnacle of financial success, but their paths to wealth accumulation raise poignant questions about fairness, government policy, and the true nature of "earning" in the context of systemic advantages.

The Role of Government in Wealth Accumulation

Warren Buffett and Elon Musk, representatives of different generations and sectors, have significantly benefited from government policies that seemingly favor the already wealthy and established. For instance, Elon Musk's ventures have gained from substantial federal subsidies, particularly for electric vehicles and renewable energy, which have been critical to Tesla's success. Similarly, Warren Buffett has made strategic investments in sectors like banking, which have historically enjoyed robust government support, especially during crises.

Questioning "Earned" Wealth: The last 20 years have seen unprecedented levels of intervention by the federal government and the Federal Reserve in the economy, from bailing out banks to injecting liquidity during economic downturns. These actions pose a significant question: would figures like Buffett and Musk be as wealthy without such interventions that have, directly and indirectly, propped up their investments and industries? While it's clear they possess acumen and strategic foresight, one might argue that the playing field has been tilted in favor of their interests, raising doubts about whether their wealth was fully "earned" under fair competition.

Generational Equity and Frustration

The frustration palpable among Gen Z and younger millennials, particularly evident in viral TikTok videos, underscores a broader sense of economic disenfranchisement.

These younger individuals, especially college-educated women in their 20s, voice concerns about being unable to afford basic necessities like rent and food, or to find jobs that align with their life goals and interests.

Economic Challenges for Younger Americans: While it's difficult to ascertain the full truthfulness of individual claims on social media platforms, the broader statistical landscape provides a grim view:

Stagnant Wages: Despite higher productivity, wages for younger workers have not kept pace, diminishing their purchasing power and economic independence.

Rising Education Costs: The escalating costs of higher education burden young adults with debt, making it more challenging to achieve financial stability.

Homeownership Hurdles: The dream of homeownership is increasingly out of reach for many due to soaring property prices and a competitive housing market.

These factors collectively contribute to a sense that younger Americans lack the economic opportunities their parents' generation took for granted. This perceived generational theft, where older and wealthier individuals continue to benefit from policies that do not favor the young, adds to the disillusionment and frustration.

The Need for a Balanced Discussion

The debate over whether wealth accumulated by today's elites was genuinely "earned" or significantly aided by favorable policies is complex and emotionally charged. It raises essential questions about the role of government in shaping economic outcomes and the fairness of these outcomes. As we reflect on the frustrations of younger generations, it is vital to consider their limited political power and how this influences their economic prospects.

This discussion isn't merely academic but is deeply personal and emotional, impacting how individuals view their prospects and their place within the economy. As we grapple with these issues, the overarching goal should be to strive for a more equitable system that balances the interests of all generations, ensuring that opportunities for wealth and success are not disproportionately skewed by age, connection, or capital.

Conclusion

Throughout this discussion, we have delved deeply into the complexities of economic inequality, generational wealth distribution, and the profound challenges faced by younger generations in today's economy. From examining the harsh statistics that paint a stark picture of widening disparities to dissecting the specific laws and policies that facilitate these disparities, it becomes evident that systemic changes are necessary. Moreover, our reflection on the narratives surrounding high-profile billionaires and the voices of frustrated younger Americans has highlighted not just the economic imbalances but the emotional and societal impacts that follow.

A Call to Action

As readers and as members of a shared community, our responsibility extends beyond understanding these issues. Action is imperative. Here are steps we can consider to foster a more equitable economic environment:

Advocate for Policy Reform: Engage with and support initiatives aimed at reforming tax policies, housing laws, and education funding. Advocacy can take many forms, from voting and participating in civic discussions to supporting organizations that lobby for economic justice.

Promote Financial Education: Education is a powerful tool in leveling the playing field. Supporting financial literacy programs for young people can help equip the next generation with the knowledge to make informed financial decisions and navigate an increasingly complex economic landscape.

Support Young Entrepreneurs and Workers: Whether through mentorship, investing in startups founded by younger individuals, or supporting businesses that prioritize fair wages and employee development, there are practical steps that can be taken to empower younger generations economically.

Foster Community Initiatives: Local initiatives often have powerful impacts. Engaging in or starting community-based projects that provide support systems for housing, education, and entrepreneurship can create microcosms of economic fairness and opportunity.

Challenge the Status Quo: This involves questioning and critically examining the economic systems and structures in place. It includes debating and discussing the merit and fairness of wealth accumulation by the few at the expense of the many, and pushing for a societal shift in how wealth and success are measured and valued.

Final Thoughts

The journey toward economic equity is fraught with challenges and complexities. However, the discussion does not end here. It is a continuous process that requires the involvement and commitment of each generation to ensure that the future holds promise for all, not just a privileged few. As we move forward, let's carry the torch of change, not out of mere frustration or despair, but with a resolute vision for justice and fairness in our economic systems. Together, let's build a foundation that upholds the dignity of work, rewards true innovation, and distributes the fruits of progress in a manner that is just and equitable. Remember, the actions we take today will shape the landscape of tomorrow. Let this be our call to action.

Editors note: In this analysis, I have chosen June 2001 as the baseline for most of the statistics presented, a month significant to me personally as it marks my graduation from high school. This timeframe encompasses several pivotal events in recent history—the 9/11 attacks, the global financial crisis, and the COVID-19 pandemic—each of which has shaped the economic landscape in profound ways.

It's worth noting that while June 2001 serves as a starting point for this exploration, similar statistical conclusions might be drawn from other historical dates. The data utilized in this article is sourced from the Federal Reserve Economic Data (FRED) and is publicly available. I encourage readers to access this data to create their own charts and graphs, and to draw their own conclusions about the economic trends and their impacts over the past two decades.