The Myth of the ‘Little Guy’ Champion: How Democrats Are Enriching the Wealthy and Aging Elite

Despite progressive promises, recent policies under Biden show a clear trend: capital and the asset-rich are winning big, leaving younger and working-class Americans behind.

As the 2024 election looms, the question of economic winners and losers under recent administrations takes on new urgency. Who truly prospered over the last few years—was it the average American worker, or did gains primarily go to those holding capital? Two charts offer a revealing glimpse: one shows how net worth surged significantly for older, wealthier Americans under President Biden, while the other demonstrates that productivity rose even as real wages stagnated.

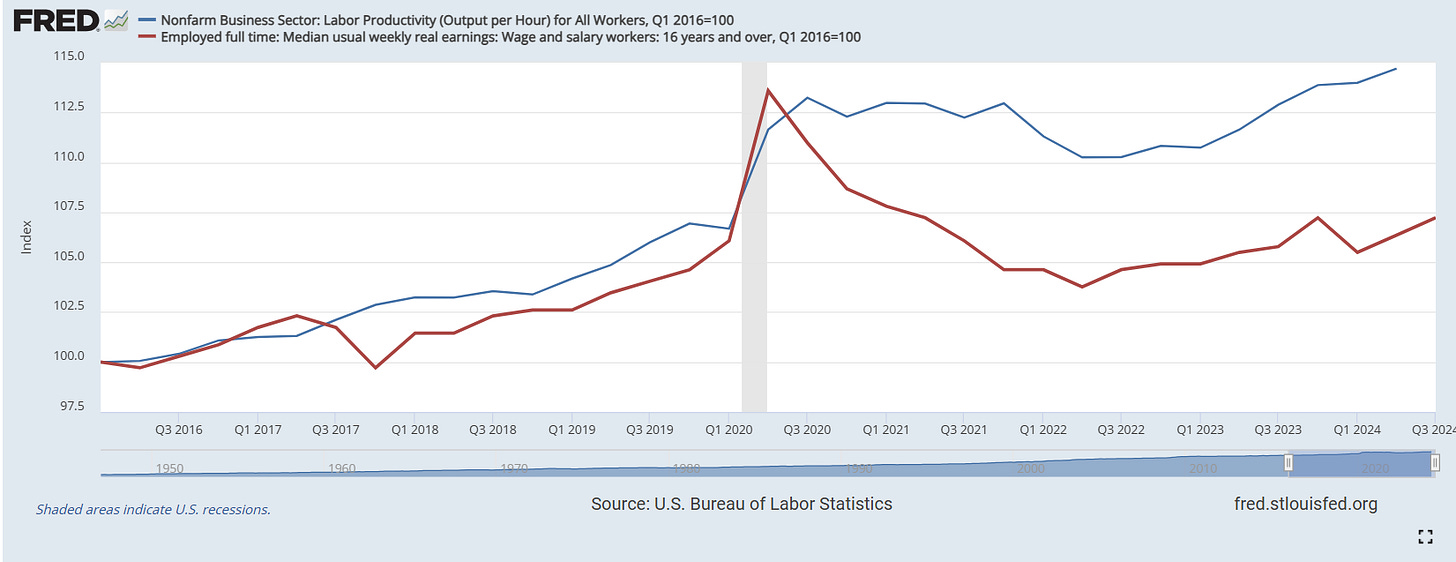

Labor vs. Capital (Wages vs. Productivity 2016-2024) - Source: F.R.E.D.

(Comparison of U.S. Labor Productivity and Real Wages (2016-2024): While labor productivity (blue line) has steadily increased, especially post-2020, real wages for full-time workers (red line) have stagnated. This growing gap highlights how gains in productivity have largely benefited capital holders rather than translating into wage growth for workers, underscoring an economic trend where capital outpaces labor.)

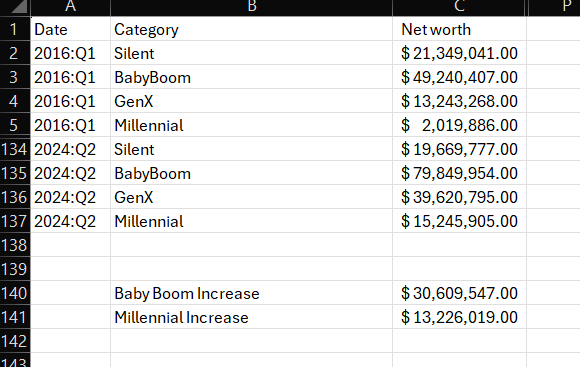

Net Worth by Generation (Absoulute Dollars 2016-2024) - Source: Federal Reserve

(Change in Net Worth by Generation (2016-2024): Over this period, Baby Boomers saw a significant increase in net worth, rising by over $30 million, while Millennials experienced a comparatively smaller gain of $13 million. This data illustrates the widening wealth gap between generations, with older, asset-holding groups benefiting disproportionately compared to younger generations.)

In examining these numbers, a striking pattern emerges: those with assets—typically Baby Boomers and the wealthy—have seen marked financial benefits, while younger generations and the working class have struggled to keep pace. This prompts a critical question: If Kamala Harris were to take the reins, would her administration champion the so-called “little guy,” or would the trends favoring capital and established wealth continue?

As we explore policies from both Biden and Trump, it becomes evident that while political rhetoric often frames Democrats as advocates for the working class, the economic realities tell a more complicated story—one that could significantly shape the future of American politics.

Wealth Gains Under Biden

The data reveals a clear pattern: older generations, particularly Baby Boomers, saw considerable growth in wealth during the Biden administration, while younger Americans experienced more modest gains. From 2016 to 2024, Baby Boomers' net worth increased by over $30 million, a stark contrast to the $13 million rise seen among Millennials. This generational wealth gap is not new, but it has intensified under Biden, whose policies—whether directly or indirectly—have favored those with assets over those who primarily rely on wages.

The FRED chart sheds more light on this trend. Labor productivity (output per hour) has steadily increased since 2016, particularly after the pandemic's economic disruptions in 2020. Despite this productivity boost, real wages for full-time workers have largely stagnated, creating a divergence that underscores a persistent issue in the American economy: gains from increased productivity have primarily flowed to capital rather than labor. In simple terms, while the economy as a whole has become more productive, the typical worker hasn't seen their paycheck grow to match that progress.

This disconnect can be attributed to how capital markets have responded to Biden’s policies. For instance, the massive stimulus packages during the COVID-19 pandemic and the Federal Reserve’s low-interest-rate policies have driven up asset values, benefiting those with substantial investments in stocks, real estate, and other capital-intensive assets. This disproportionately benefits Baby Boomers, who hold a larger share of these assets compared to younger generations.

In addition, Biden’s emphasis on green energy and infrastructure through legislation like the Inflation Reduction Act has stimulated capital-heavy industries. Although these initiatives aim to create jobs, they also increase demand for materials, real estate, and financial services, which predominantly benefit existing asset holders. Consequently, Baby Boomers, who tend to be wealthier and more invested in these sectors, have reaped substantial gains.

In contrast, younger Americans, particularly Millennials, are more likely to rely on wages and face the burdens of rising housing and education costs, with fewer capital assets to appreciate in value. This imbalance in wealth growth across generations presents a sharp contrast between Biden's stated support for the middle class and the economic outcomes we observe: those with assets, primarily older Americans, have thrived, while younger, asset-poor workers struggle to keep pace.

In sum, Biden's policies, though aimed at economic recovery and growth, have primarily benefited the asset-rich—often older Americans—while leaving younger workers to grapple with rising costs and stagnant wages.

Key Policies Under Biden and Trump: Fueling the Wealth Gap

To understand why wealth distribution shifted the way it did under both Trump and Biden, we need to look at the economic policies each administration pursued—and how these policies impacted capital holders versus the average worker. While both presidents operated in vastly different economic landscapes, their approaches inadvertently reinforced a similar outcome: greater gains for those with assets and minimal wage growth for workers.

Trump’s Policies: The Tax Cuts and Deregulation Strategy

Trump’s administration touted a pro-business approach, primarily focused on tax cuts and deregulation. His 2017 Tax Cuts and Jobs Act (TCJA) was the centerpiece of this strategy, slashing the corporate tax rate from 35% to 21% and providing tax relief for individuals as well. While the tax cuts were intended to stimulate economic growth and benefit American workers through corporate reinvestment, in practice, much of this relief went toward corporate stock buybacks and dividend payments, benefiting shareholders rather than boosting wages.

Moreover, the TCJA’s focus on capital gains tax relief disproportionately favored wealthier Americans who derive more income from investments. As a result, the wealthiest households—many of whom are older and hold the majority of America’s financial assets—saw substantial gains in their net worth. Meanwhile, the hoped-for “trickle-down” effects on wage growth largely failed to materialize. For Millennials and younger Americans, who rely primarily on wages rather than investments, this policy mix offered limited direct benefits, further widening the generational wealth gap.

Biden’s Policies: COVID-19 Stimulus and Capital-Heavy Initiatives

Biden took office amid an unprecedented global pandemic and launched several large-scale stimulus efforts to stabilize the economy. His American Rescue Plan delivered direct cash payments, extended unemployment benefits, and boosted the child tax credit. Initially, these measures provided essential support to working-class and middle-income families, temporarily lifting millions out of poverty and boosting consumer spending. However, the effects were short-lived, and by mid-2021, most direct relief measures had expired.

Where Biden’s policies diverged most significantly from Trump’s was in his focus on long-term investments in infrastructure and green energy, through legislation like the Inflation Reduction Act and the Bipartisan Infrastructure Law. These policies prioritized investments in capital-intensive industries—such as electric vehicle production, renewable energy infrastructure, and broadband expansion. While these initiatives were marketed as job creators, they have primarily benefited corporations and investors in these sectors, driving up asset values in stocks and real estate rather than resulting in direct wage increases for most workers.

Additionally, the Federal Reserve’s prolonged low-interest-rate policies during Biden’s term played a critical role in bolstering asset prices. Low rates made borrowing cheaper, fueling increased investment in housing, stock markets, and other assets. This environment particularly favored Baby Boomers, who tend to have significant investments in these areas. Millennials, who were less likely to own property or large investment portfolios, found themselves further disadvantaged by rising asset prices, particularly in housing, which continued to climb out of reach for many young Americans despite wage stagnation.

What a Harris Administration Could Mean for Wealth Inequality

Looking ahead, a potential Kamala Harris administration would likely carry forward many of Biden’s economic initiatives, especially those aimed at green energy and infrastructure. Given Harris’s alignment with Biden on policy, we can anticipate a continued focus on capital-intensive projects. While this may stimulate overall economic growth, it risks perpetuating the same wealth concentration among capital holders that we’ve seen under Biden.

Moreover, Harris’s progressive agenda might include new measures to address inequality, such as expanding social safety nets or increasing taxes on high earners. However, such moves may not significantly alter the balance of wealth if the core economic strategy remains capital-focused. In other words, even if more social programs are introduced, the underlying emphasis on asset-driven growth could still favor wealthier, older Americans over younger workers.

In essence, both Trump’s tax cuts and Biden’s capital-heavy investment policies have fueled a wealth gap that benefits older, asset-rich Americans over younger, wage-dependent workers. If Harris assumes office and follows a similar policy path, we can expect this trend to persist, challenging the assumption that progressive policies inherently benefit the working class. Despite differences in rhetoric, both administrations have effectively bolstered capital, leaving younger, labor-reliant Americans on the sidelines.

Implications: The Real Beneficiaries of “Progressive” Policies

The conventional narrative paints Democrats as the champions of the working class, standing up for the "little guy." But as we examine the economic realities under Biden’s administration, a different picture emerges. Despite progressive rhetoric, policies that were supposed to lift the middle class often ended up bolstering capital holders, favoring older and wealthier Americans over younger, working-class citizens. This gap raises questions about who really gains under a supposedly pro-worker administration—and what this could mean for the upcoming election.

The data illustrates a widening divide. Despite Biden’s promises to support middle-class Americans, the charts reveal how capital, not labor, has reaped the rewards. The FRED chart highlights that while labor productivity has steadily risen, wages for full-time workers have stagnated. Labor is doing more, producing more, but workers aren’t seeing the corresponding financial benefits. Instead, the gains have primarily flowed to those with substantial investments in capital markets, who are predominantly Baby Boomers and the wealthy.

This discrepancy is further emphasized in the net worth data. Baby Boomers, many of whom already control significant wealth and hold substantial assets, saw their net worth increase by over $30 million from 2016 to 2024. In contrast, Millennials, whose wealth primarily depends on wages rather than investments, experienced a much smaller gain of just $13 million. This disparity underscores how policies under Biden—despite a stated focus on the middle class—ended up reinforcing existing wealth structures. Policies that boost asset values, such as low-interest rates and large-scale government spending, disproportionately benefit those who already hold assets. Younger generations, facing high living costs and limited capital investment opportunities, are unable to accumulate wealth at the same pace, widening the generational wealth gap.

Notably, Social Security beneficiaries received substantial Cost-of-Living Adjustments (COLA) during the pandemic years due to inflation—5.9% in 2022 and a historic 8.7% in 2023, the largest increases in nearly 40 years. These adjustments, driven by rising prices for necessities, provided a crucial financial boost to older Americans dependent on Social Security. Meanwhile, younger workers saw their modest wage gains largely offset by the skyrocketing costs of essentials like housing, food, and healthcare. Inflation, partly fueled by COVID-19 stimulus spending and lingering supply chain issues, has effectively eroded real income for younger generations, deepening the wealth divide across age groups.

The irony here is that progressive, capital-intensive policies often exacerbate the very economic divides they purport to bridge. Infrastructure spending, green energy investments, and low-interest-rate policies do stimulate the economy, but their benefits are concentrated. While real estate and stock markets surge, working-class Americans—who typically lack significant investments—see little improvement in their financial standing. The wage growth they do experience often fails to keep up with the cost of living, as asset markets inflate beyond their reach.

Under a Harris administration, this trend would likely continue given her alignment with Biden’s economic and social policies. Harris has signaled her support for expanding social equity measures, which could include further social safety nets or potential tax increases on the wealthy. Yet, if the core economic strategy remains capital-focused—emphasizing investments in infrastructure and green industries—the real beneficiaries will still likely be those with assets. For Millennials and younger Americans, this approach suggests more of the same: incremental support through social programs but little in terms of transformative change that would enable them to build wealth at the pace of older generations.

In sum, while Democratic policies may be framed as being “for the little guy,” the economic outcomes reveal a different story. On election day, voters may need to question this narrative. The party often seen as the defender of working-class Americans has, in practice, created policies that ultimately favor the wealthy and asset-rich. As we consider the possibility of a Harris presidency, it’s worth asking whether progressive policies as currently structured are truly designed to support those who need it most—or if they’re simply perpetuating a system where the rich continue to get richer, while generational wealth divides deepen.

Conclusion: What This Means for the 2024 Election

As we approach the 2024 election, the question of who truly benefited economically under recent administrations—and who is likely to benefit going forward—should be top of mind for voters. Both the Biden and Trump years demonstrated a recurring theme in American politics: policies that, despite differing intentions and rhetoric, ended up disproportionately enriching the wealthy, particularly older Americans who hold the majority of the nation’s assets.

Biden’s policies, with a focus on large-scale investments in infrastructure and green energy, and Trump’s tax cuts, aimed at spurring corporate growth, ultimately rewarded capital over labor. These approaches have driven up asset values and enhanced wealth for those who were already asset-rich, primarily Baby Boomers. Younger Americans, still trying to build wealth through wages and facing escalating living costs, saw far fewer of these gains. The gap between the generations—and between capital and labor—has only widened as a result.

Looking forward, if Kamala Harris were to assume the presidency, it’s likely her administration would continue much of the economic agenda set by Biden. This would mean continued emphasis on capital-intensive sectors like technology and green energy, which could fuel further gains in asset markets. While a Harris administration might introduce progressive reforms aimed at social equity, the underlying structure of these policies may still favor capital. In other words, without significant structural change, the rich are likely to keep getting richer, with the benefits of economic growth continuing to flow toward established wealth holders rather than those striving to build their own wealth.

Furthermore, the rise of artificial intelligence (AI) could deepen this labor-capital divide even further. As companies increasingly adopt AI-driven technologies, the productivity gains are likely to benefit capital holders disproportionately. Automation and AI are poised to replace a wide range of jobs, especially in sectors like manufacturing, logistics, and customer service, which have traditionally provided stable employment for the working class. In this scenario, companies benefit from reduced labor costs, while capital owners—those invested in firms utilizing AI—see increased returns. For workers, however, this could mean fewer opportunities in traditional labor markets and a shift toward lower-paying, less secure jobs that cannot be easily automated.

AI-driven growth may also concentrate wealth in high-tech and data-driven industries, which are capital-heavy by nature and often located in affluent urban centers. This geographic and economic concentration could further amplify inequality, benefiting those already positioned in the tech and finance sectors. Unless there is deliberate policy intervention—such as reskilling programs, tax policies that redistribute AI-generated wealth, or stronger social safety nets—AI could exacerbate wealth inequality and generational divides, making it even harder for younger and lower-income Americans to build wealth.

For voters, this presents a critical question: Can the Democratic Party truly claim to be “for the little guy” if its policies, however progressive in tone, continually enrich the already wealthy and deepen generational divides? And while Biden and Harris may represent stability and continuity, this may also mean a continuation of the status quo—a system where the gains of economic growth are not broadly shared, but concentrated among those with capital.

As election day nears, voters may need to challenge their assumptions about who benefits from progressive policies. The idea that Democrats represent the working class may not hold up against the data we see today. Regardless of campaign promises, the economic trends under Biden—and likely under Harris—suggest that older, asset-rich Americans stand to benefit the most, leaving younger generations and the working class still waiting for their share of the prosperity. With the added impact of AI on the horizon, the implications for the 2024 election are clear: voters must decide if they are content with this reality, or if they will demand a shift toward policies that genuinely prioritize economic equity across generations and income brackets, ensuring that the technological advancements of AI benefit all Americans—not just those at the top.