The Boomer Wealth Bubble: Why It's Time to Turn Off the Spigots

Reforming Policies to Empower Younger Generations and Limit Redistribution

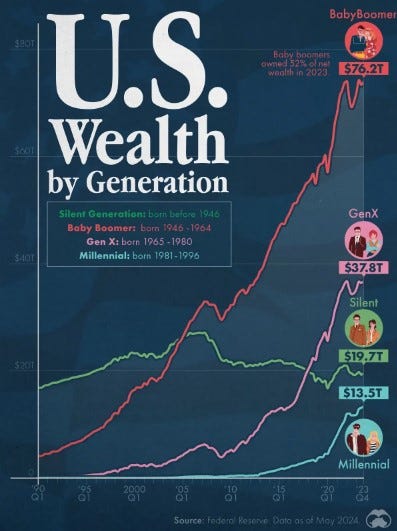

Let's take a moment to reflect on this revealing infographic depicting U.S. wealth distribution by generation. The Baby Boomers, born between 1946 and 1964, hold an astonishing $76.2 trillion in net wealth, dominating over half of the nation's total. This stark contrast to Gen X, the Silent Generation, and Millennials calls for a closer examination of how we got here and where we should go next.

Source: Visual Capitalist

The Fortunate Generation

The Baby Boomers were undoubtedly the most fortunate generation in history. Their timing couldn't have been better—born in the post-World War II era, they enjoyed unprecedented economic growth. They witnessed the rise of the knowledge economy, technological advancements, and the financialization of the economy. These factors collectively set the stage for immense wealth accumulation.

Moreover, Boomers have disproportionately held positions of power. Take a look at Congress: the average age of a U.S. senator is around 64, and for House members, it's about 58. Specific examples include Nancy Pelosi (aged 84), Mitch McConnell (aged 82), Donald Trump (aged 78), and Joe Biden (aged 81). This dominance in political spheres has allowed Boomers to influence policies that favor their interests, further consolidating their wealth.

Benefiting from Economic Policies

In the last decade or so, Boomers have reaped significant benefits from economic policies. They were in the perfect position, with the liquidity and assets needed, to pounce on depressed equity prices during financial crises. When the Global Financial Crisis hit, equity prices plummeted. Those with cash reserves and the means to leverage their investments—primarily Boomers—were able to buy these undervalued assets at rock-bottom prices.

The aftermath of the crisis saw central banks implementing Zero Interest Rate Policy (ZIRP) and Quantitative Easing (QE) to stabilize the economy. These policies led to a flood of cheap money in the market. Boomers, who already held significant assets, leveraged these low-interest rates to acquire more assets. They could borrow cheaply and invest in stocks, real estate, and other asset classes, which subsequently inflated in value due to the liquidity injected by these monetary policies.

This environment of low interest rates and high leverage created an ideal scenario for asset inflation. Those with the initial capital—again, primarily Boomers—saw their wealth multiply, while younger generations, who lacked the liquidity and assets to invest heavily, missed out on these gains.

Limiting Government Redistribution

Here’s the crux of the issue: the government’s ability to redistribute wealth through transfer payments and subsidies disproportionately benefits the older generations. Social Security is the most prominent example, but there are other policies at play. Medicare, pension plans, and even tax structures that favor home ownership (predominantly a benefit for older, wealthier individuals) all contribute to this wealth transfer.

Government positions and structures also enable this dynamic. For example, the exclusion of Social Security income from taxable income up to a certain threshold benefits wealthier retirees who can structure their income to avoid taxes. Furthermore, the mortgage interest deduction primarily benefits those who own homes, a demographic skewed towards older generations. Another example is the preferential tax treatment of retirement accounts, where Boomers have had decades to accumulate tax-advantaged savings.

Additionally, specific subsidies and government programs disproportionately benefit older generations. Agricultural subsidies often benefit large, established farmers who are typically older. Similarly, healthcare spending tends to favor Medicare recipients, who are all 65 and older.

Proposed Solutions

So, what do we propose? Firstly, we need to limit the government’s role in wealth redistribution. This means reducing transfer payments and subsidies that favor the wealthy older generations. Instead, policies should be crafted to promote economic freedom and opportunities for all, without government overreach.

Recognizing the Nature of Social Security: It's important to remember that Social Security is not a savings account but a transfer payment from one generation to another. Older generations are not "owed" these payments based on prior contributions; instead, it's a system funded by current workers to support current retirees. This understanding is crucial in making the case for reform.

Gradually Reducing Social Security and Medicare for Affluent Seniors: While some seniors rely on Social Security as their primary income, the accumulation of wealth by the Boomer generation indicates that a reduction in these benefits would not be as catastrophic as feared. By adjusting benefits based on income and wealth, we can ensure that those who truly need support receive it, while those who are more affluent contribute more to their own retirement and healthcare costs.

Reevaluating Tax Advantages and Subsidies: Beyond transfer payments, we must address tax advantages and subsidies that disproportionately benefit affluent senior Americans. This includes revising the mortgage interest deduction, reevaluating tax breaks for retirement accounts, and reducing subsidies that benefit older, wealthier demographics.

Eliminating Social Security Benefits for Younger Generations: For those under 40, we should phase out Social Security and instead offer tax credits for retirement savings in IRA-type private accounts. This approach empowers individuals to manage their retirement savings and reduces dependency on government programs.

Identifying the Moral Purpose of Government: Politics is inherently influenced by morality, and the predominant morality of our time is altruism or “other-ism”. This has led to soft fascism, crony capitalism, and authoritarianism, where government intervention often benefits a select few at the expense of the many. We must recognize that the morality of altruism is the problem. Until we address this underlying issue, no political solution will be feasible. The morality and culture must change to prioritize individual responsibility and economic freedom over collective redistribution.

Conclusion

The wealth amassed by Baby Boomers highlights a need for a serious reevaluation of our entitlement programs and economic policies. By limiting government redistribution, phasing out Social Security for younger generations, and adjusting benefits for affluent seniors, we can ensure a more equitable distribution of resources and foster economic freedom.